-

News

-

Blog

-

Archive

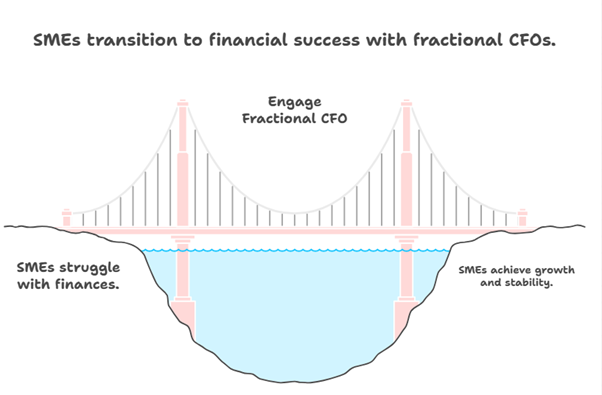

Is your small or medium-sized enterprise (SME) experiencing growing pains? Perhaps you're struggling to manage cash flow, prepare for funding, or simply lack the strategic financial guidance you need to reach the next level. A Fractional CFO could be the answer. This blog post explores five key signs that indicate your SME is ready to benefit from the expertise of a part-time Chief Financial Officer, offering insights and practical examples relevant to the UK business landscape.

Rapid Revenue Growth

Rapid revenue growth is often seen as a positive sign, but it can also strain an SME's resources and expose underlying weaknesses in financial management. Many UK SMEs experience this. As moneyweek.com often highlights, scaling too quickly without proper financial controls can lead to cash flow problems and ultimately hinder growth.

Real-world example: Imagine a Manchester-based e-commerce business experiencing a surge in online orders. While sales are booming, the company struggles to manage increased inventory costs, longer payment cycles from suppliers, and the need to invest in new technology. Without a CFO to analyse these trends, optimise pricing strategies, and implement robust financial forecasting, the business risks overspending and running into cash flow difficulties.

How a Fractional CFO can help: A Fractional CFO can provide the financial expertise needed to manage rapid growth effectively. They can develop accurate financial models, optimise pricing strategies, improve cash flow management, and ensure that the business has the financial resources to support its expansion. They can also help secure funding if needed.

Complex Cash Flow Issues

Cash flow is the lifeblood of any business, and managing it effectively is crucial for survival and growth. According to simplybusiness.co.uk, poor cash flow management is a leading cause of SME failure in the UK. Complex cash flow issues can arise from various factors, including seasonal fluctuations, delayed payments from customers, and unexpected expenses.

Real-world example: A construction company in Birmingham might face significant cash flow challenges due to the long payment cycles common in the industry. They may have to wait several months to receive payment for completed projects, while still needing to pay suppliers and employees on time. This can create a significant strain on their finances, making it difficult to invest in new equipment or take on new projects.

How a Fractional CFO can help: A Fractional CFO can help SMEs overcome complex cash flow issues by implementing effective cash flow forecasting, optimising payment terms with customers and suppliers, and identifying opportunities to improve working capital management. They can also help secure short-term financing if needed to bridge cash flow gaps.

Preparing for Funding or Exit

Whether you're seeking investment to fuel growth or planning to sell your business, preparing for funding or exit requires meticulous financial planning and due diligence. Potential investors or buyers will scrutinise your financial statements, business plans, and forecasts.

Real-world example: A tech startup in London seeking venture capital funding needs to present a compelling financial story to potential investors. This includes developing detailed financial projections, demonstrating a clear path to profitability, and showcasing the company's growth potential. A Fractional CFO can help the startup prepare a robust financial model, conduct due diligence, and negotiate favourable terms with investors.

How a Fractional CFO can help: A Fractional CFO can guide SMEs through the funding or exit process by preparing financial statements that meet investor or buyer requirements, developing realistic financial projections, and providing strategic advice on valuation and negotiation. They can also help manage the due diligence process and ensure a smooth transaction.

Overwhelmed In-House Finance Team

As your business grows, your in-house finance team may become overwhelmed with the increasing complexity of financial tasks. They may lack the expertise or bandwidth to handle strategic financial planning, complex reporting, or compliance requirements.

Real-world example: A manufacturing company in Sheffield may have a small finance team that is primarily focused on day-to-day bookkeeping and accounting tasks. They may struggle to keep up with the increasing complexity of financial reporting, tax compliance, and cost accounting. This can lead to errors, missed deadlines, and a lack of strategic financial insights.

How a Fractional CFO can help: A Fractional CFO can supplement your in-house finance team by providing expertise in areas where they lack the necessary skills or experience. They can help streamline financial processes, implement new accounting systems, and provide training to your existing finance staff. This allows your in-house team to focus on their core responsibilities while ensuring that your business has access to the financial expertise it needs.

Lack of Strategic Financial Planning

Strategic financial planning is essential for long-term success. Without a clear financial roadmap, SMEs may struggle to make informed decisions about investments, pricing, and resource allocation. Accountingweb.co.uk often discusses the importance of strategic financial planning for SMEs.

Real-world example: A retail business in Glasgow may be struggling to compete with larger chains due to a lack of strategic financial planning. They may not have a clear understanding of their profitability by product line, customer segment, or location. This makes it difficult to make informed decisions about pricing, marketing, and inventory management.

How a Fractional CFO can help: A Fractional CFO can work with you to develop a comprehensive financial plan that aligns with your business goals. They can help you identify key performance indicators (KPIs), set financial targets, and track your progress towards achieving your goals. They can also provide strategic advice on investment decisions, pricing strategies, and resource allocation.

Accountants in Manchester can provide valuable support during the transition to a Fractional CFO model. They can assist with identifying the right CFO for your needs, integrating the CFO into your existing finance team, and ensuring a smooth handover of responsibilities. Furthermore, Accountants in Manchester can offer ongoing support with bookkeeping, accounting, and tax compliance.

If you recognise any of these signs in your SME, it may be time to consider hiring a Fractional CFO. Contact YRF Accountants today for a consultation and discover how we can help you unlock growth and improve your financial performance.