-

News

-

Blog

-

Archive

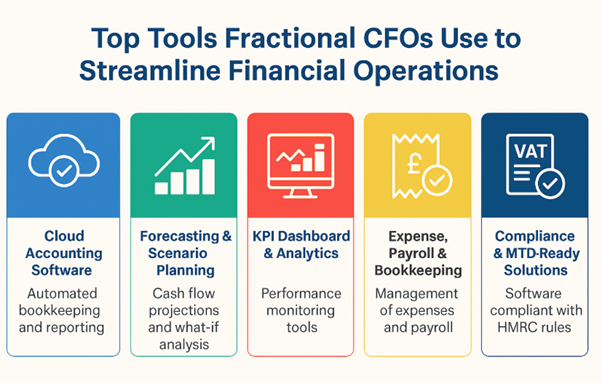

Fractional CFOs are increasingly vital for UK SMEs seeking strategic financial guidance without the expense of a full-time executive. These seasoned professionals leverage modern tools to deliver cost-effective support, transforming financial operations and driving business growth. This article explores the key tools that empower Fractional CFOs to streamline financial processes, enhance decision-making, and ensure compliance, ultimately benefiting UK SMEs.

Cloud Accounting Software

Cloud accounting software has revolutionised financial management for businesses of all sizes. Platforms like Xero, QuickBooks, and FreeAgent offer a suite of features that automate routine tasks, provide real-time insights, and facilitate seamless collaboration. Automation of bank feeds eliminates manual data entry, while automated reconciliation processes save time and reduce errors. Real-time reporting capabilities provide up-to-the-minute financial data, enabling Fractional CFOs to make informed decisions quickly. According to insights from Accounting WEB, UK businesses are increasingly adopting cloud accounting solutions to improve efficiency and gain a competitive edge. MoneyWeek also highlights the benefits of cloud accounting in simplifying tax compliance and improving cash flow management for SMEs.

Forecasting and Scenario Planning Tools

Effective forecasting is crucial for managing cash flow and making strategic decisions. Tools such as Float, Futrli, and Spotlight Reporting enable Fractional CFOs to create rolling forecasts, project cash flow, and model various "what-if" scenarios. These tools allow businesses to anticipate potential challenges and opportunities, adjust their strategies accordingly, and secure funding when needed. By visualising future financial performance, Fractional CFOs can help businesses make proactive decisions that drive sustainable growth.

KPI Dashboards & Analytics Tools

Key Performance Indicators (KPIs) provide a snapshot of a business's financial health and operational efficiency. KPI dashboards and analytics tools, such as Fathom, Syft, and Power BI with Excel, enable Fractional CFOs to monitor critical metrics like gross margin, burn rate, return on investment (ROI), and customer acquisition cost (CAC). These tools present data in an easy-to-understand format, allowing businesses to identify trends, spot anomalies, and make data-driven decisions. By tracking KPIs, Fractional CFOs can help businesses optimise their performance and achieve their strategic goals.

Expense, Payroll & Bookkeeping Tools

Streamlining expense management, supplier payments, and payroll processes is essential for improving efficiency and reducing administrative overhead. Tools like Dext, Pleo, and BrightPay automate these tasks, saving time and reducing errors. Dext automates the capture and processing of receipts and invoices, while Pleo provides company cards with spending limits and real-time expense tracking. BrightPay simplifies payroll processing and ensures compliance with UK tax regulations. By automating these processes, Fractional CFOs can free up time to focus on more strategic initiatives.

Compliance & MTD-Ready Solutions

Compliance with tax regulations is a critical aspect of financial management. Fractional CFOs ensure that businesses comply with HMRC requirements, including VAT returns and Making Tax Digital (MTD) regulations. Software solutions that are MTD-ready simplify the process of submitting VAT returns digitally, reducing the risk of errors and penalties. Updates from Gov.uk and SimplyBusiness provide valuable information on MTD requirements and compliance best practices. Fractional CFOs stay up-to-date with these changes and ensure that businesses are fully compliant.

Many businesses in the UK seek assistance with implementing these tools and training their teams to ensure better financial control and compliance. Accounting firms Bolton can provide the necessary support and expertise to help businesses leverage these tools effectively.

Furthermore, Accounting firms Bolton can offer tailored solutions to meet the specific needs of each business, ensuring that they are equipped to manage their finances efficiently and effectively.

Conclusion with CTA

Fractional CFOs play a crucial role in helping UK SMEs navigate the complexities of financial management. By leveraging modern tools, they can streamline financial operations, enhance decision-making, and ensure compliance. If you're looking to improve your business's financial performance, consider partnering with a Fractional CFO and exploring the tools mentioned in this article. Explore the key tools that streamline finance operations for SMEs, and how accounting firms Bolton can help implement them effectively.