-

News

-

Blog

-

Archive

The idea of a fractional CFO—a part-time financial leader who provides strategic direction without the full-time expense—is examined in this article, along with the reasons why expanding companies in the UK benefit most from this model. We'll explore the benefits of hiring a fractional CFO, particularly given the state of the economy, and how companies like Accountants in Bolton can support the success of companies.

What Is a Fractional CFO?

A Chief Financial Officer who works on a project or part-time basis is known as a fractional CFO. Businesses can hire a fractional CFO for a set number of hours or days per week or month in place of hiring a full-time CFO, which can be very expensive, particularly for small to medium-sized businesses (SMEs) and scale-ups. High-level financial knowledge and strategic leadership are accessible through this arrangement without the cost of a full-time salary and benefits package. As a crucial member of the leadership team, the fractional CFO provides insights and direction to improve financial performance and accomplish organisational objectives.

Top Benefits of Hiring a Fractional CFO

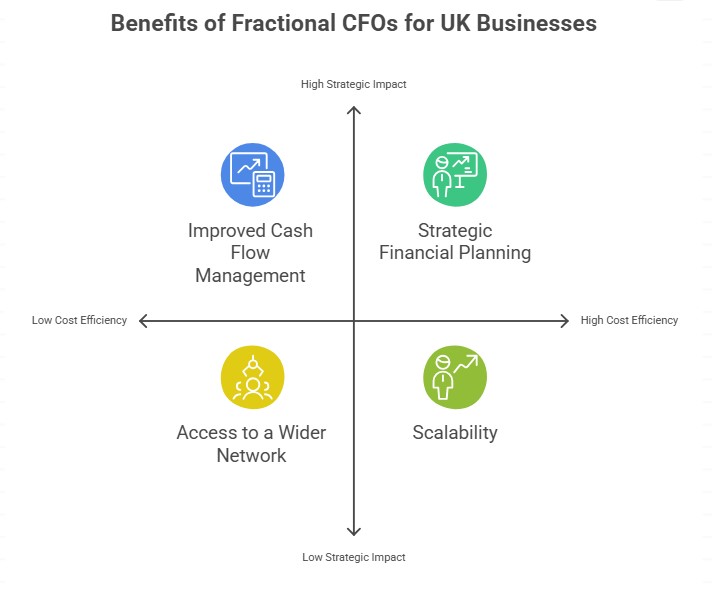

Engaging a Fractional CFO offers a multitude of benefits, particularly for UK businesses navigating growth and change:

- Cost Efficiency: This is possibly the strongest benefit. It can cost a lot of money to hire a full-time CFO. By offering the same degree of experience at a fraction of the price, a fractional CFO enables companies to make more strategic resource allocations.

- Strategic Financial Planning: A fractional CFO offers extensive expertise in creating and executing financial plans that complement corporate goals. They can assist in forecasting future performance, developing strong financial models, and locating areas for expansion and enhancement.

- Improved Cash Flow Management: For any business to survive and succeed, effective cash flow management is essential. A fractional CFO can put plans into action to maximise cash flow, enhance working capital management, and guarantee that the company has enough money to pay its debts and make expansion investments.

- Scalability: A company's financial requirements get more complicated as it expands. By assisting companies in effectively scaling their financial operations, a fractional CFO can make sure that the procedures and systems are in place to accommodate future expansion.

- Access to a Wider Network: Bankers, investors, and other professionals are among the many contacts that fractional CFOs frequently have. They can use these networks to assist companies in navigating the business environment, locating strategic partners, and obtaining funding.

The UK Context: SMEs, Rising Costs, and the "Fractional Twin" Trend

The business environment in the UK offers special opportunities and challenges, especially for SMEs and scale-ups. Businesses are under pressure to find cost-effective solutions due to rising National Insurance (NI) costs and other overheads. A larger trend towards flexible and agile business models is reflected in the growing "fractional twin" trend, in which companies are increasingly implementing fractional leadership roles across multiple functions.

A fractional CFO can make all the difference in this setting. They can assist companies with funding opportunities, navigating complicated regulations, and optimising their financial performance. Companies like Accountants in Bolton are aware of the unique requirements of UK companies and can offer solutions that are specifically designed to support their success.

Is a Fractional CFO Right for You?

To find out if a fractional CFO is the best choice for your company, think about the following questions:

- Is your company expanding quickly?

- Do you require assistance creating a financial plan?

- Do you have trouble efficiently managing your cash flow?

- Do you require access to advanced financial knowledge but lack the funds for a full-time CFO?

- Do you want to enhance your compliance and financial reporting?

A fractional CFO might be a great asset to your company if you said "yes" to any of these questions.

Accountants in Bolton: Your Partner for Growth

Accountants in Bolton are well-positioned to help you explore the benefits of a Fractional CFO. To assist you in reaching your financial objectives, they can evaluate your unique needs and suggest a customised solution. Get a consultation with Bolton accountants right now to find out how a fractional CFO can revolutionise your company.