-

News

-

Blog

-

Archive

Every year, thousands of self-employed individuals and small business owners in Bolton miss tax deadlines or submit inaccurate tax returns — often without even realising it.

Let's explore the most common self-assessment mistakes, how they can cost you money (or worse), and what a professional accountant can do to help.

Why Self-Assessment Is a Big Deal

If you're:

- A sole trader

- A landlord

- A company director

- Or someone earning over £1,000 outside PAYE…

...you likely need to submit a self-assessment tax return. This isn't just admin — it's a legal obligation, and HMRC is quick to fine those who get it wrong.

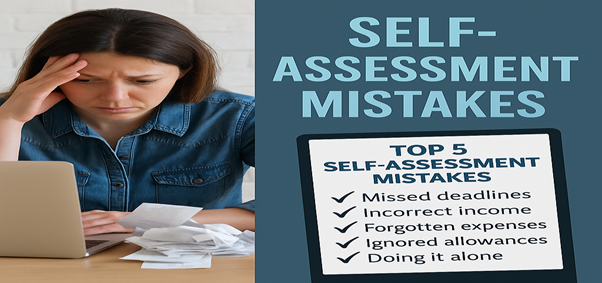

The Top 5 Mistakes We See in Bolton

- Missing the 31 January deadline

- Even one day late = £100 penalty.

- Delay past 3 months = fines grow quickly.

- Underreporting income

- Side income, rent, dividends, or foreign income — HMRC has ways to find them.

- Incorrect or excessive expense claims

- “Business use” of your phone or home needs to be calculated properly.

- No receipts or records

- You need to keep proof of your claims for at least 5 years.

- Using the wrong tax code or forgetting payments on account

- This can lead to surprise tax bills later.

How a Bolton Accountant Prevents These Mistakes

With YRF Accountants, you get:

- Accurate income reporting and expense tracking

- Deadline reminders and timely submission

- Maximised tax savings

- Expert advice if you receive an HMRC letter

- Peace of mind if your accounts are reviewed

Explore our full Self-Assessment service for details.

Should You Do It Yourself?

If your tax affairs are simple, self-filing is possible — but for many, the risk isn't worth it. Hire a local Bolton accountant if you:

- Own property

- Run a business

- Work in CIS

- Have foreign income

- Are unsure what you can claim

Don't Wait for a Penalty Letter

We help dozens of people across Bolton file their self-assessment stress-free.

Get in touch or call 01204 938696 and let us take the pressure off.